Instant Funding Scaling Plan

Exclusive Code 10%: «PROP10»

Overview of the Scaling Models

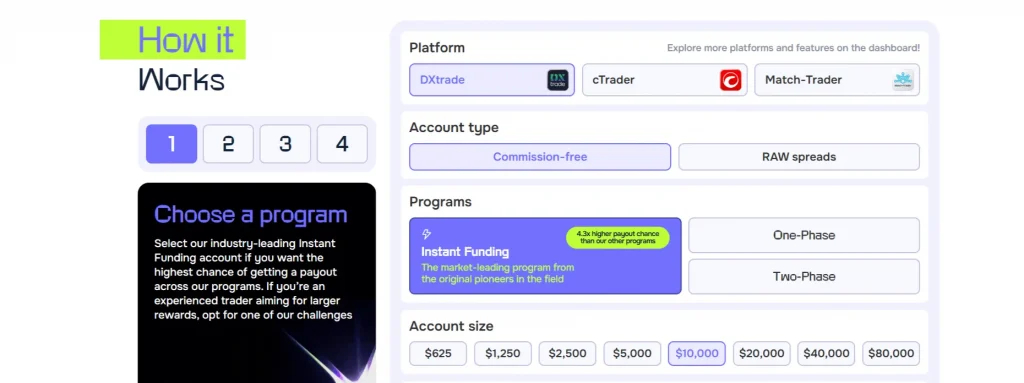

Instant Funding provides scaling across two main account types:

- Instant Funding Accounts – immediate access to capital, scaling based on performance alone.

- Challenge Accounts (One-Phase and Two-Phase) – accounts that begin with a profit target and evaluation, then scale based on performance and time.

Each model follows a structured path with defined criteria. The scaling plan is not automatic across all account types and requires understanding key milestones.

Scaling Criteria by Account Type

| Parameter | Instant Funding | One-Phase Challenge | Two-Phase Challenge |

| Initial Capital Requirement | Immediate funding | Evaluation phase (10%) | Two phases (10% → 5%) |

| Scaling Trigger Condition | Profit ≥ 10% | Profit ≥ 10% + 90 days | Profit ≥ 10% + 90 days |

| Scaling Frequency | No cooldown (manual) | Every 90 days | Every 90 days |

| Scaling Amount per Cycle | x2 account balance | +25% of initial balance | +25% of initial balance |

| Maximum Scaled Account Size | $1,280,000 | 2× initial balance | 2× initial balance |

| Request Needed? | No (instant) | Yes (via support) | Yes (via support) |

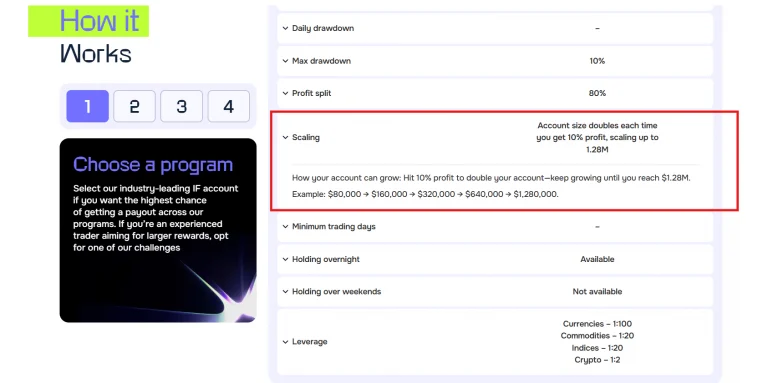

Scaling Logic: Instant Funding Accounts

For Instant Funding accounts, the scaling logic is direct and performance-based. Once a trader reaches a 10% profit on the account, a “Scale Account” button becomes available in the dashboard—provided that all positions are closed.

Step-by-step:

- Reach 10% net profit.

- Close all open trades.

- Press the scale button inside your dashboard.

- 5% of your original balance is retained by the firm to fund the scale.

- Your account size is doubled; the rest of the profit is withdrawn or retained in the new balance.

Example:

- Starting balance: $10,000

- Profit reached: $1,000

- 5% fee: $500 (used for scale)

- New account size: $20,000

- Remaining profit: $500

This can be repeated up to a capped size of $1,280,000. Every scaling event requires a new 10% profit based on the scaled balance, not the original.

Scaling Logic: Challenge Accounts

Challenge accounts (One-Phase and Two-Phase) follow a different path. Scaling is based on both profit milestones and a 90-day cooldown period.

To request a scaling increase:

- You must have reached a profit of 10% or more.

- At least 90 calendar days must have passed since the funded account was activated.

- You need to contact support to request a review.

Once approved, your account balance increases by 25% of your initial funded amount, not your current balance.

Example:

- Initial balance: $100,000

- Profit over 90 days: $11,000 (11%)

- Scaling increase: $25,000 (25% of original)

- New balance: $136,000 (including profit)

This can continue every 90 days, up to double the initial funded balance (i.e., $200,000 cap on a $100k account).

Scaling Limitations and Rules

Although the scaling system appears straightforward, there are important constraints that determine eligibility:

Key Rules:

- Only profit from closed trades is considered valid toward scaling.

- All open positions must be closed before scaling can be triggered (Instant Funding only).

- The $600,000 initial capital limit still applies—this includes $400,000 across Challenge accounts and $200,000 across Instant Funding accounts.

- Scaling does not affect the calculation of that limit (only starting balances count).

- You must not have violated any rules in the previous trading cycle to qualify.

These rules are not negotiable. If violated, scaling will not be granted, and in some cases, prior scale events may be rolled back.

Scaling Add-On and System Behavior

Some traders report confusion around whether scaling requires add-ons or affects other account functions. According to the official FAQ:

- No add-on is required to scale your account.

- The smart drawdown feature is recalculated after scaling.

- Consistency rule (best day ≤ 40% of total profit) still applies on scaled accounts.

- Scaling does not reset the account; trade history remains intact.

This means that while scaling gives you more capital, it also raises the risk ceiling. If your strategy doesn’t adapt to larger balances and tighter drawdown-to-size ratios, performance could degrade after scaling.

Risk Considerations After Scaling

Scaling increases opportunity, but also exposure. Larger accounts magnify both gains and losses. Based on feedback in user groups (Discord, Reddit), common issues after scaling include:

Common Risks Post-Scaling:

- Overleveraging newly increased accounts

- Failing the consistency rule on large single trades

- Not adjusting lot sizing appropriately for new drawdown caps

- Misinterpreting the reset of profit targets and drawdown floors

Traders often make the mistake of doubling risk after scaling, expecting the same margin of safety. Instead, firms may reapply the original drawdown cap relative to the scaled balance, leaving less breathing room.

Conclusion

After examining the details of the Instant Funding Scaling Plan, it’s clear the firm offers a clear path for traders to grow their accounts, provided they follow performance-based and time-based criteria. The Instant Funding account offers automated, recurring doubling, while Challenge accounts scale manually and more conservatively.

The system rewards consistent, rule-abiding behavior—but demands patience and discipline. Scaling is not a shortcut, but a tool designed for traders who trade responsibly over weeks or months.

Before attempting to scale, ensure you’ve carefully reviewed all eligibility conditions. Mistakes—especially around rule violations—can halt your progress or invalidate your growth path.

FAQ:

There’s no fixed number, but you can continue scaling in 10% profit intervals until the account reaches $1,280,000.

No. The 90-day waiting period is mandatory, even if you hit the profit target early.

For Instant Funding accounts, 5% of your original balance is taken as a scaling fee. For Challenge accounts, there’s no explicit fee.