Instant Funding Rules

Exclusive Code 10%: «PROP10»

Core Account Rules

Risk Rules Table

| Rule/Parameter | Instant Funding | One-Phase Challenge | Two-Phase Challenge |

| Max Drawdown | 10% | 8% | 10% |

| Daily Loss Limit | None | 3% | 5% |

| Profit Target | None | 10% | 10% in Phase 1, 5% in Phase 2 |

| Minimum Trading Days | None | 3 | 3 |

| Profit Split | 80% (up to 90%) | 80% (up to 90%) | 80% (up to 90%) |

| Weekend Position Holding | With Add-On Only | With Add-On Only | With Add-On Only |

| Smart Drawdown Activation | After 5% Profit | After Funded Phase | After Phase 1 |

| Platform Options | MT5, cTrader, MTT | MT5, cTrader, MTT | MT5, cTrader, MTT |

Strategy Restrictions and Banned Behavior

Instant Funding enforces a list of prohibited strategies to prevent system abuse and maintain control over trade replication risk.

Prohibited Strategies Include:

- Martingale systems: Any doubling down after losses is not allowed.

- Grid trading: Spacing multiple orders without confirmation is banned.

- HFT or latency arbitrage: Trades must remain open for more than 60 seconds.

- News trading: Orders opened or closed within 4 minutes of major economic events are not permitted.

- Single-direction stacking: Continuously placing positions in one direction across multiple pairs is prohibited.

- Over-leveraging: Breaching lot size limits tied to account type can result in disqualification.

Even traders who manually follow the rules can run into trouble if they use automated systems not fully aligned with these constraints. It’s strongly advised to double-check your strategy setup before going live.

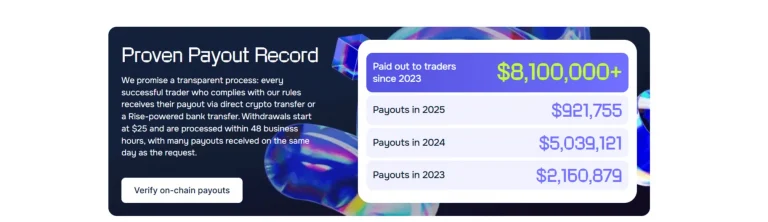

Consistency and Payout Criteria

Unlike many firms that focus solely on performance metrics, Instant Funding uses behavioral checks to measure consistency before approving withdrawals. One key rule is the “Best Day Profit Limit.”

Payout Conditions Overview:

- First payout: Eligible after 14 days from your first trade.

- Subsequent payouts: Available every 7 days after any new trade.

- Minimum withdrawal: $25

- Best trading day rule: Your top single trading day cannot represent more than 40% of your total profit.

- Profit threshold to request payout: 1.5% of the initial balance, or $25 minimum.

Violating the best-day rule disqualifies you from payouts for that cycle, even if your account is otherwise profitable. This approach heavily penalizes traders who rely on high-impact single trades and encourages smoother equity curves.

Add-Ons and Trading Flexibility

While Instant Funding presents a rigid rule set, it offers paid add-ons to increase flexibility. These are optional but essential for certain styles like swing or weekend trading.

Add-Ons

- Weekend Holding: Allows open trades through Friday market close.

- Unlimited Time: Removes time constraints in evaluation phases.

- Swap-Free Mode: Disables swap charges for overnight positions.

Add-ons are purchased during the signup process or added later via your dashboard. Without them, some standard trading practices—like holding trades through economic releases or weekends—will result in automatic disqualification.

Rule Enforcement: Strict but Predictable

Feedback from the trading community shows that rule enforcement at Instant Funding is automated and rigid. There’s very little room for negotiation. Many traders report losing access to their funded accounts after unintentional violations, especially tied to:

- Incorrect lot sizing

- Holding positions too close to major news

- Forgetting to enable an add-on before performing a restricted action

It’s essential to remember: Instant Funding Rules are enforced whether you’ve read them or not. There’s no appeal system publicly stated, and the support team typically refers users back to the platform’s written policies.

Conclusion

From this review of Instant Funding Rules, it’s clear that the company prioritizes structured and automated enforcement over discretionary review. Rules are straightforward but demand constant attention to detail. There’s very little gray area.

While many of the firm’s conditions mirror common prop firm practices, others—like the consistency rule—are stricter than average. Traders looking for freedom in execution strategies will likely need to adjust their methods to remain compliant.

If you’re planning to join Instant Funding, take the time to understand not just the profit conditions, but also the compliance side. One wrong move could end your access to a funded account.

FAQ:

Some EAs are permitted, but martingale, grid, and latency-based bots are explicitly banned.

You won’t receive a payout for that cycle. The rule applies to all payout requests, including instant withdrawals.

No. Trading rules are platform-agnostic, though some interface features may differ.