Instant Funding cTrader

Exclusive Code 10%: «PROP10»

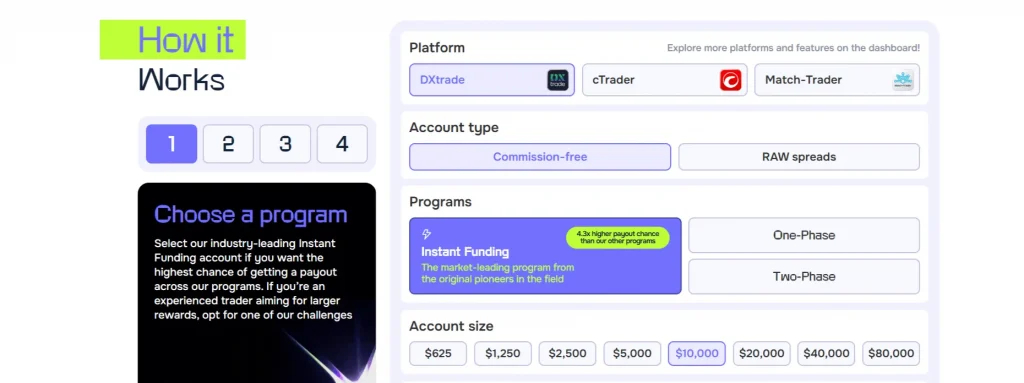

Platform Overview

cTrader is known for its transparent execution, responsive user interface, and advanced charting features. It’s often preferred by discretionary traders and those building custom automated systems via cAlgo, the platform’s native algorithm scripting tool.

Key Features of cTrader:

- Full multi-asset support (FX, indices, commodities, crypto)

- Fast order execution and Level II pricing (DOM)

- Built-in economic calendar

- Detachable chart windows

- Support for automated trading via cAlgo

- Multiple order types and advanced charting

Traders using Instant Funding cTrader get access to the same instrument classes as on other platforms, but the interface and performance tools differ. The execution model is STP-simulated and mirrors real market behavior.

Trading Conditions

Using cTrader at Instant Funding does not change the trading rules. The same global parameters apply across all platforms. However, the user experience can differ depending on execution latency and interface layout.

Trading Conditions on Instant Funding cTrader

Category | Specification |

Max Drawdown | 10% of starting balance |

Daily Loss Limit | Not enforced |

Profit Target | None (for Instant Funding account) |

Leverage – Forex | 1:100 |

Leverage – Indices | 1:20 |

Leverage – Crypto | 1:2 |

Weekend Trading | Only with add-on |

Overnight Holding | Allowed |

Smart Drawdown | Activates after 5% profit |

Platforms Supported | Windows, macOS, iOS, Android, Web |

These are the base technical conditions. They apply across all Instant Funding account types (Instant, One-Phase, Two-Phase), though some features like drawdown management are tied to account type and profit status.

Strategy Restrictions and Prohibited Methods

cTrader’s open API allows advanced strategy creation, but Instant Funding enforces strict compliance rules to avoid high-risk behaviors. Traders using automation via cAlgo must ensure all logic complies with Instant Funding policy.

Disallowed Strategies:

- Martingale systems

- Grid trading structures

- Arbitrage and latency-based trading

- High-frequency trading (HFT under 60 sec execution)

- News straddles: trading within ±4 minutes of major economic events

- Hedging in correlated pairs in opposite directions

Violation of any of the above will result in termination of the funded account and forfeiture of accrued profits, regardless of account performance. These restrictions apply identically on cTrader, MT5, and Match-Trader.

Payout System for cTrader Accounts

Instant Funding supports a structured and transparent payout model, with access to profits provided in stages. Once traders meet eligibility conditions, payouts can be withdrawn through USDC (ERC-20) or the RISE platform.

Payout Rules Overview:

- First payout: Eligible 14 days after the first trade

- Subsequent payouts: Available every 7 days after new trades

- Minimum withdrawal: $25

- Payment method: USDC ERC-20 or via RISE

- Processing time: Typically within 48 business hours

- Best day rule: Most profitable trading day must be ≤40% of total profit

All these conditions apply to cTrader users identically. There are no platform-based exceptions. Violating any payout eligibility rule—even if technical performance was strong—will delay or void your payout request.

Account Scaling with cTrader

cTrader accounts are fully eligible for Instant Funding’s Scaling Plan. This allows account growth through either profit triggers or fixed 90-day intervals (for Challenge models).

Scaling Conditions:

- Profit threshold: 10% net profit required

- Positions must be fully closed before requesting scaling

- 5% of the original balance is retained to fund scaling (Instant model)

- Max scaled account: up to $1,280,000 for Instant Funding accounts

- For Challenge models: scale every 90 days by +25% of initial balance

Scaling is a manual process in Challenge accounts (support request required) and automatic in Instant accounts (button activates in the dashboard when eligible).

Technical Considerations for cTrader

While the rule structure is identical across platforms, user experience on cTrader may differ in the following ways:

Feature | Comment |

Execution latency | Slightly faster than MT5 in some regions |

Depth of Market (DOM) access | Native support, unlike MT5 |

Trade analytics | Built-in statistics and trade history visualization |

Automated strategy deployment | cAlgo allows for deep customization |

Account notifications | Alerts appear via email and within platform |

Traders who prefer data-rich UIs and DOM tools may find cTrader more intuitive than other platforms. However, all risk controls are enforced externally via Instant Funding’s risk engine, not by the platform interface.

Final Thoughts

The Instant Funding cTrader platform offers a robust, flexible environment for discretionary and algorithmic traders alike. Its features cater to serious traders who rely on transparency, stability, and flexible order management. However, the flexibility of cTrader does not remove the firm’s strict enforcement of its trading rules.

Whether you’re scaling your account or building a portfolio of automated strategies, compliance with Instant Funding’s rules remains mandatory. cTrader gives you tools; the firm sets the boundaries.

Choose this platform if you’re comfortable managing multiple variables in real-time and prefer more granular control over your trade execution environment.

FAQ:

Yes, via cAlgo. But your bot must not use prohibited methods like martingale, grid, or news trading.

Yes. Scaling is available as long as the required conditions are met.

Your account may be terminated, and profits forfeited. Rule enforcement is identical across platforms.