Instant Funding

Exclusive Code 10%: «PROP10»

Virtual Trading Account Structure

| Feature | Instant Funding | One-Phase | Two-Phase |

| Profit Target | None | 10% | 10% & 5% |

| Daily Drawdown | N/A | 3% | 5% |

| Max Drawdown | 10% | 8% | 10% |

| Profit Split | 80% | 80-90% | 80-90% |

| Min Trading Days | None | 3 | 3 |

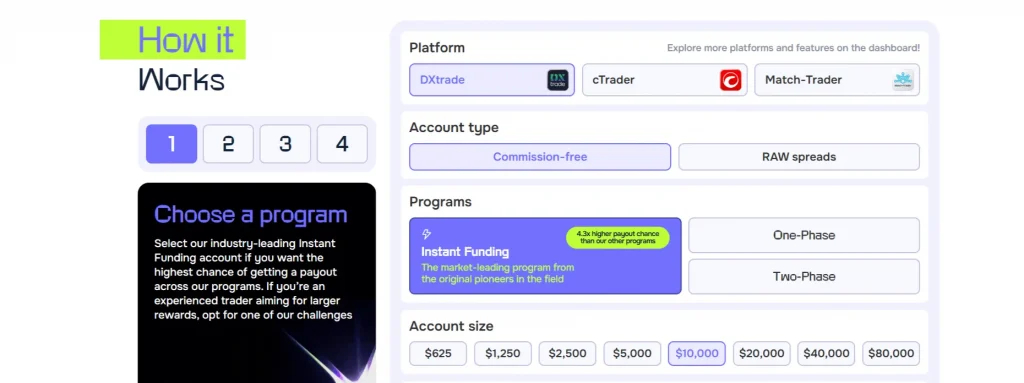

Trading Platform Infrastructure

The system utilizes three primary trading interfaces: DXtrade, cTrader, and Match-Trader with dedicated server clusters. Each platform connects through redundant data centers ensuring 99.76% uptime. Trade execution occurs through institutional-grade liquidity providers. The infrastructure supports simultaneous trading of 50+ instruments across multiple asset classes. Real-time price feeds stream from Tier-1 liquidity sources.

Technical Parameters

Trading capabilities include:

- Leverage ratios: 1:100 (currencies), 1:20 (indices/commodities), 1:2 (crypto)

- Order types: Market, limit, stop, trailing stop

- Maximum positions: 15 concurrent trades

- Minimum trade size: 0.01 lots

- Maximum spread deviation: 1 pip

Account Scaling Framework

| Metric | Requirement | Timeframe |

| Profit Target | 10% | No limit |

| Max Drawdown | 10% | Per account |

| Position Hold | Optional | 14 days |

| Scaling Speed | 2x/25% | Immediate/90 days |

| Max Scale | $1.28M/100% | Program dependent |

Risk Management Protocol

Advanced risk monitoring systems track position exposure across accounts. The platform implements automated drawdown controls and position size limitations. Real-time equity protection prevents excessive risk-taking. Trading restrictions adjust during major economic events. Position correlations undergo continuous analysis.

Drawdown Controls

The system enforces:

- Maximum daily drawdown limits

- Real-time equity monitoring

- Automatic position closure at limits

- Risk-adjusted position sizing

- Correlation-based exposure limits

Analytics Dashboard Integration

Comprehensive performance tracking provides detailed trading metrics. The system generates risk-adjusted return calculations and drawdown analysis. Position sizing recommendations adapt to account conditions. Pattern recognition algorithms identify trading opportunities. Historical performance data enables strategy optimization.

Market Access Parameters

| Asset Class | Number of Instruments | Standard Leverage | News Leverage |

| Currencies | 28 pairs | 1:100 | 1:30 |

| Indices | 12 indices | 1:20 | 1:10 |

| Commodities | 8 products | 1:20 | 1:8 |

| Cryptocurrencies | 6 pairs | 1:2 | 1:1 |

Loyalty Program Structure

The Plus rewards system provides $100 welcome points upon registration. Members receive birthday incentives and exclusive scaling opportunities. Point accumulation occurs through trading volume and account maintenance. The system tracks member status through automated monitoring. Regular promotional events offer enhanced profit splits.

Technical Integration Features

The platform incorporates advanced charting capabilities with 50+ technical indicators. Custom indicator development supports algorithmic trading strategies. Multiple timeframe analysis enables comprehensive market review. Chart pattern recognition assists trade identification. Historical data access facilitates strategy backtesting.

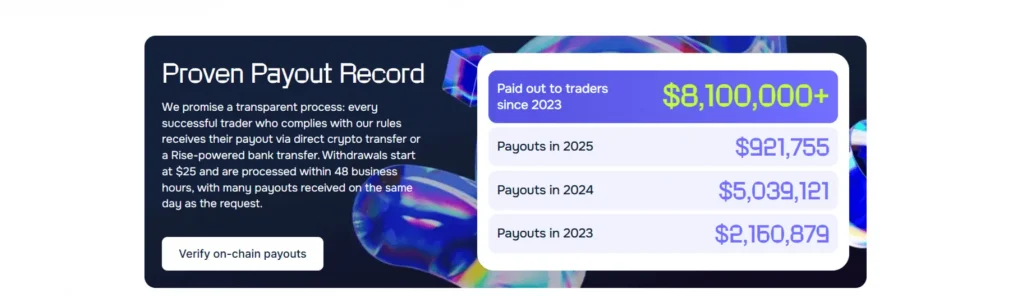

Payment Processing System

The platform processes payouts through cryptocurrency transfers and bank wires. Minimum withdrawal amounts start at $25 after initial 14-day trading period. Weekly payment processing occurs within 48 business hours. The system supports multiple withdrawal currencies. Payout verification occurs through automated compliance checks.

Transaction Security

Security measures include:

- Multi-factor authentication

- Encrypted payment channels

- Automated fraud detection

- KYC verification

- Blockchain transaction validation

Educational Integration

The platform provides systematic trading education through an automated dashboard. Performance metrics generate personalized learning recommendations. Trading pattern analysis identifies improvement areas. Strategy backtesting tools enable risk-free practice. Real-time market analysis supports decision-making.

Support Infrastructure

Support services operate 24/7 with 33-second average response times. Technical assistance covers platform functionality and trading conditions. Dedicated account managers provide scaling guidance. The system maintains automated issue tracking and resolution. Multi-language support serves global traders.

FAQ:

Instant Funding accounts have no minimum trading day requirement, while One-Phase and Two-Phase challenges require 3 minimum trading days.

Smart Drawdown accounts double in size upon reaching 10% profit, scaling up to $1.28M. Static Drawdown accounts receive 25% increases every 90 days, up to 100% of starting balance.

Payouts start from $25, available after 14 days of initial trading and weekly thereafter. Processing occurs within 48 business hours through cryptocurrency or bank wire transfers.